The majority of energy trading is done ahead of time between suppliers and generators, and later refined in the spot markets closer to real time. Following this, we ensure that supply meets demand by taking action within the Balancing Mechanism (BM). However, ahead of the BM, we also have the ability to trade with parties.

NGESO carries out trades with parties for three key purposes:

- To balance the system where there is a foreseen energy requirement

- To ensure system security where there may be constraint

- To meet forecast NGESO balancing requirements at minimum cost.

The most granular tradable period is a single half-hour block.

To deliver these trading services, potential providers will either be contracted directly or agree to a Grid Trade Master Agreement (GTMA) and have an account with a UK-registered bank. A GTMA is a legally-agreed trading mandate between us and each counterparty. They must also have either sufficient credit rating or a letter of credit. There are several schedules within the GTMA, each of which governs a different method of trading:

Schedule 7A sets out the provisions for BM Unit Specific Transactions. The service enables us agree a trade to either increase or decrease their output to a specific volume for an agreed price and time. The transactions require the counterparty to submit and maintain agreed physical notifications for the times in the trade. This would then also be notified to the Energy Contract Volume Aggregation Agent to ensure that the party’s contractual position is correctly adjusted.

Schedule 8 allows for a trade to be agreed over the interconnectors at the day ahead stage subject to the outturn of the counterparty’s trading activity on European power exchanges. These are known as Power Exchange Linked Interconnector (PELI) BM Unit Transactions.

Forward bilateral trades

Forward trading via bilateral agreements (typically between a day ahead and one hour ahead).

Forward trades are bilateral contracts negotiated between NGESO and counterparties. The bilateral market is of great importance to NGESO. Our trading requirements are often not met by standard products, usually because we are trading for a specific location or aiming to achieve a specific level of generation/demand or flow on the network. Therefore, we will often contact counterparties directly to negotiate a trade with defined parameters. These bilateral trades can either take place with interconnector counterparties or BMU-specific counterparties.

Contract enactment

Balancing contracts are agreements for services that are procured to balance and secure the system. For further information, please see Balancing Services.

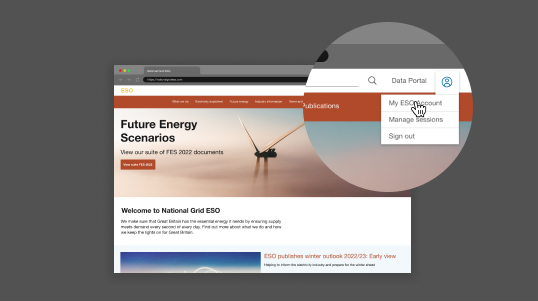

All the details of our trading are shared on the data portal

- Upcoming trades – all trades entered into that are to be delivered

- Historic trades – all historic trades can be found here

- Interconnector requirements and Auction summary – the aggregated summary of each auction we run to determine which trades to agree to

- Interconnector Trading Procurement Framework – the documentation relating to our trading including any supporting material

For enquiries about trading, trading data or becoming a registered interconnector trading partner email: [email protected]

DISBSAD data can be found here for all trades that have been delivered and who they are with DISBSAD | BMRS (bmreports.com)

If required, change tab title to: All upcoming Grid Trade Master Agreement (GTMA) trades can be accessed and downloaded through our trade data page. This page displays all upcoming electricity trades due to be delivered, and no sooner than 90 minutes from the current time. The website pulls new trade data every ten minutes.